Sales of previously owned homes in America fell less than expected in August, as prices fell from a year earlier, the National Association of Realtors said yesterday.

(note Silver Lining: Most economists agree that this gives the Federal Reserve even more reasons to halt any future increases and consider a reversal of the consecutive rate hikes we have all felt).

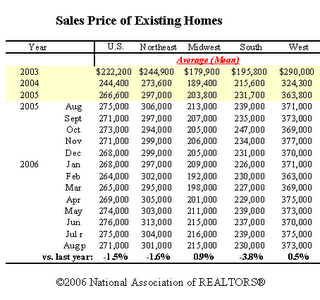

The median price of a home was $225,000 in August, compared with a revised $230,000 in July. Last month's price was 1.7% below a year earlier, making it the first year-to-year median price decline since April 1995. Some predict as the inventory of homes gets smaller prices may hold stable or even get stronger

Economists claimed that this correction was overdue and that many consumers wishing to sell their homes want to get the most out of their appreciation. Thus they are demanding unrealistic prices for their homes. In many parts of the country home values increased 50% over the last two years.

NAR Chief Economist David Lereah said an anticipated decline in prices compared with a year earlier has begun and is likely to continue until the end of the year, helping to support sales. "With sales stabilizing, we should go back to positive price growth early next year," Mr. Lereah said.

While the NAR price data are not as thorough as the quarterly reports from the Office of Housing Enterprise Oversight, economists say the August price decline may signal pressure ahead on home-equity withdrawals and consumer spending.

Comments